My Great Lakes FAQs: Are you trying to find answers to your MyGreatLakes questions? If so, this blog post is for you! This post will answer the top 8 most frequently asked questions about MyGreatLakes. We’ll give you the information you need to understand how MyGreatLakes works, what services they provide, and how to make the most of your account. Read on to learn more!

How do I log in to MyGreatLakes?

Logging in to MyGreatLakes is a simple process. To start, visit the MyGreatLakes website and click the “Sign In” link at the top of the page. Then enter your username and password to gain access to your account information. You may also log in with your Social Security Number if you have already registered it with MyGreatLakes.

What is the difference between a Stafford Loan and a PLUS Loan?

A Stafford Loan is a government-subsidized loan available to undergraduate and graduate students to help pay for their education. A PLUS Loan, on the other hand, is a non-need-based loan available to parents and graduate students to cover their educational expenses. The significant difference between these two types of loans is that the interest rate on a PLUS Loan is higher than that of a Stafford Loan.

How do I consolidate my loans?

MyGreatLakes allows you to consolidate your federal student loans with one application easily. The application process is simple and secure and can be done entirely online. After submitting your application, MyGreatLakes will help you compare consolidation options so that you can find the best loan solution for you. Once your application is approved, you’ll receive one new loan with a single monthly payment, saving you time and money.

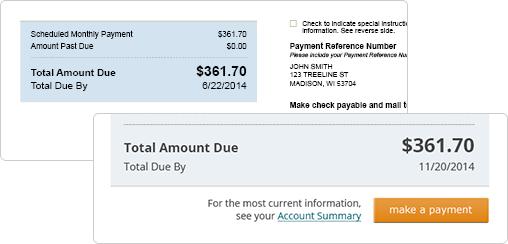

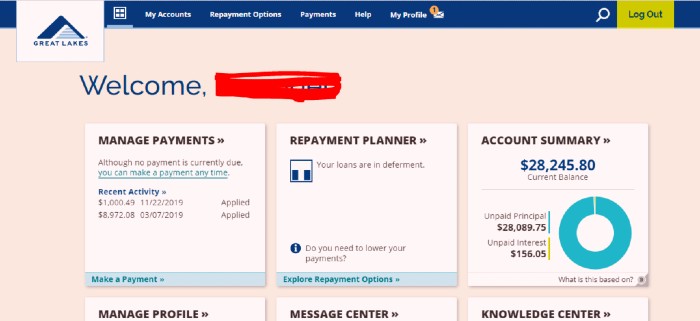

How do I make payments on my loans?

Making payments on your loans is easy with MyGreatLakes. You can make payments online or set up automatic payments, so you don’t have to worry about missing a payment. Additionally, you can pay by phone, mail, or in person.

When do I have to start making payments on mygreatlakes loans?

Typically, you must begin making payments on your student loans six months after you leave school or drop below half-time enrollment. You will receive an email notification with your loan servicer’s contact information before the repayment period starts. In addition, MyGreatLakes provides a personalized payment calendar to help you stay on top of your payments.

What are the consequences of defaulting on mygreatlakes loans?

Defaulting on a loan from MyGreatLakes can have serious consequences. Your credit score may be negatively impacted, and you could face wage garnishment, legal fees, and collection costs. Additionally, you may not be eligible for additional federal student aid if your loans default.

How can I get help if I’m making my payments?

If you are having difficulty making your payments, MyGreatLakes offers a range of options to help. You can call their customer service team for personalized assistance and advice on making your loan more manageable. Additionally, you can visit their website’s “Manage My Account” page to learn more about options such as loan deferment and forbearance.

Is this online portal secure to use?

Yes! MyGreatLakes takes security very seriously and uses the latest encryption technology to keep your data safe and secure. All personal information is stored securely, and only authorized personnel can access it. Your data is protected by strong passwords, two-factor authentication, and other advanced measures to protect your information and privacy.

Leave a Reply